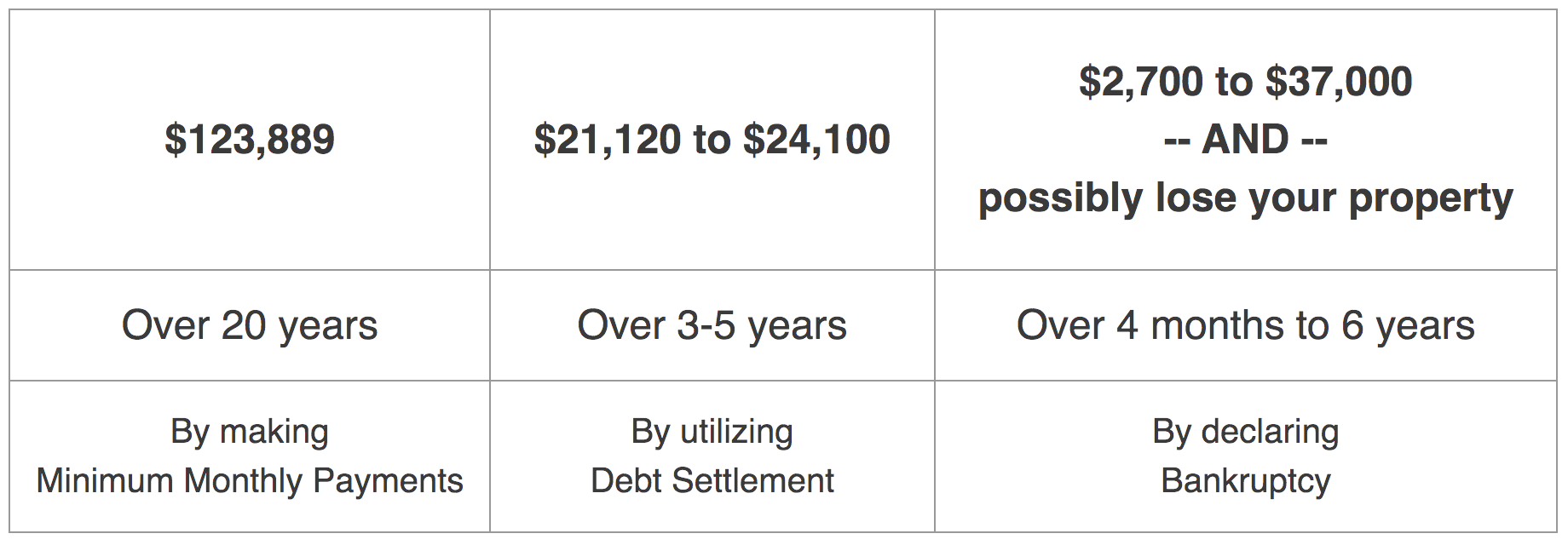

IF YOU OWE $30,000 IN DEBT, DO YOU WANT TO PAY...

Plus, which option will give you the best chance to get a car or home loan?

Feel trapped by your debt? Time to break free!

In Greek mythology Sisyphus was the king of Ephyra. He was condemned by Zeus to an eternal punishment of rolling an immense boulder up a hill, only to have it roll back down each time he neared the top. Sisyphus never did reach his freedom. Does this sound like you every time you make progress with your debt? Or maybe you don’t even try and you end up letting your debt pile up further.

It is time to push that boulder of debt over the hill and achieve your freedom. And we’ll help you get there!

In our research and experience, we’ve compiled the best options and how to determine which is right for you. We’ve consulted bankruptcy attorneys, financial attorneys, licensed financial advisors, debt settlement experts, and even Biblical financial advisors. Of course, because you haven’t hired us to be your attorney (whether we could represent you or not) we must provide the standard caveat, so read the Disclaimer below (click on the link if needed).

Now, let’s begin…

YOUR OPTIONS

But, you might say, what about…

Lump sum payments? If you can afford that, why are you here?

Getting a new credit card and doing a 0% balance transfer? Fraught with peril. Don’t do it.

Borrow from your retirement? Have you seen the tax consequences?

Take a 2nd mortgage? Tricky, but maybe… I’m not getting into it here.

First you need to know –

HOW TO THINK ABOUT DEBT

Call me a debt doctor, if you will. And do this for a simple reason, getting out of debt is just like losing weight.

Think about your options like your physical wellbeing. If you’re unhealthy, it takes action to get in good shape. If you do nothing, you won't improve. The same goes for your wallet. If you don’t put a plan in place and take action, you won’t reach your goal. In fact, without action you'll slide backwards and then the path forward is that much harder. So start today! But be smart. Thousands and thousands of people have been down this road. Use their hard-earned wisdom to avoid the potholes and take the best route to financial health.

Following that analogy:

Minimum Monthly Payments = working out on your own.

Buy a gym membership, get some dumbbells for home, or start running the miles. It can work, but it’s difficult and most people can’t sustain this at a proper pace. The discipline and time commitments required are tough to meet. How many gym membership cards get used after a few months? How dusty do the dumbbells in the closet get after a few weeks? Work hours, the commute, kids and family, school, parents, the dog, cooking dinner, socializing, and even TV are both important obligations as well as daily distractions. Because you need to give both time and energy to get educated and be disciplined on self-workouts. And it's easy to slip up. Then cheat days lead to running the credit cards back up once there is room, taking back more burdens, weighing you down and ruining any progress you've made.

Bankruptcy = laparoscopic surgery (stomach stapling or the band). A viable option for those in desperate need or with certain preconditions. But surgery is always extreme. And there will always be extra repair work needed after the program, when you lose the weight. But for those without much alternative, it can be the only life saving device to get you back on shore.

Debt Settlement = joining a gym and hiring a personal trainer. You are in a program, with support and guidance from an educated team with experience to get you in shape. You will have a bit of soreness at first, but then you'll see the development you've made with your trainers and start to enjoy the freedoms you've earned.

How would we rank these options? On the basis of which is most likely to succeed.

To that end, Debt Settlement is the clear choice. Completing the process on your own (aka minimum monthly payments) is admirable. And some may argue a fulfillment of obligations you took on. Afterall no one forced you to run up your credit cards (student loans are another matter, and we’ll discuss those later). But debt settlement is an offer to your creditors to settle out your debts. It is an agreement you make together. They do not have to accept it. But they do. And you work out a solution with them. That is honorable too.

CASE STUDY

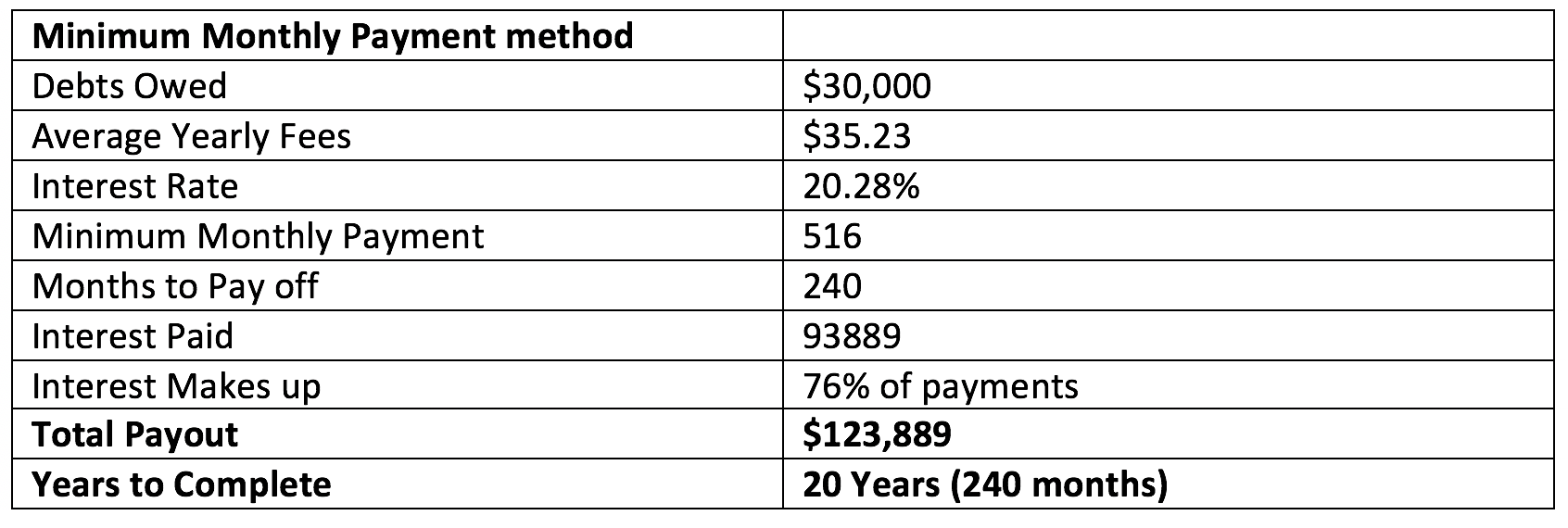

For $30,000 in debt (everyone has a different level of debt, so let’s use round off to common amount we’ve seen a lot). And as I said above, student loans are a different animal, so let’s keep this to credit cards and other unsecured debts.

Minimum Monthly Payments:

As a general rule the bankruptcy attorneys we spoke to estimated credit card debt payoff on a minimum monthly payment schedule as paying 3x the balance over 20+ years. That means paying $90k on a $30k balance. Depending on your cards and rates, this is good way to generalize it. However, it could be worse. According Bankrate.com for a $30k balance paid out over 20 years, with average rates* you would actually pay $123,889. That’s 4x the balance, and $93k in interest alone. Ouch. Credit Karma and Nerd Wallet calculate it the same, give or take a few dollars. And according to them, if you could somehow pay extra each month and finish the payoff in 14 years, you would “only” pay $90k. That’s still 3x the current balance and $60k in interest!

Debt Settlement:

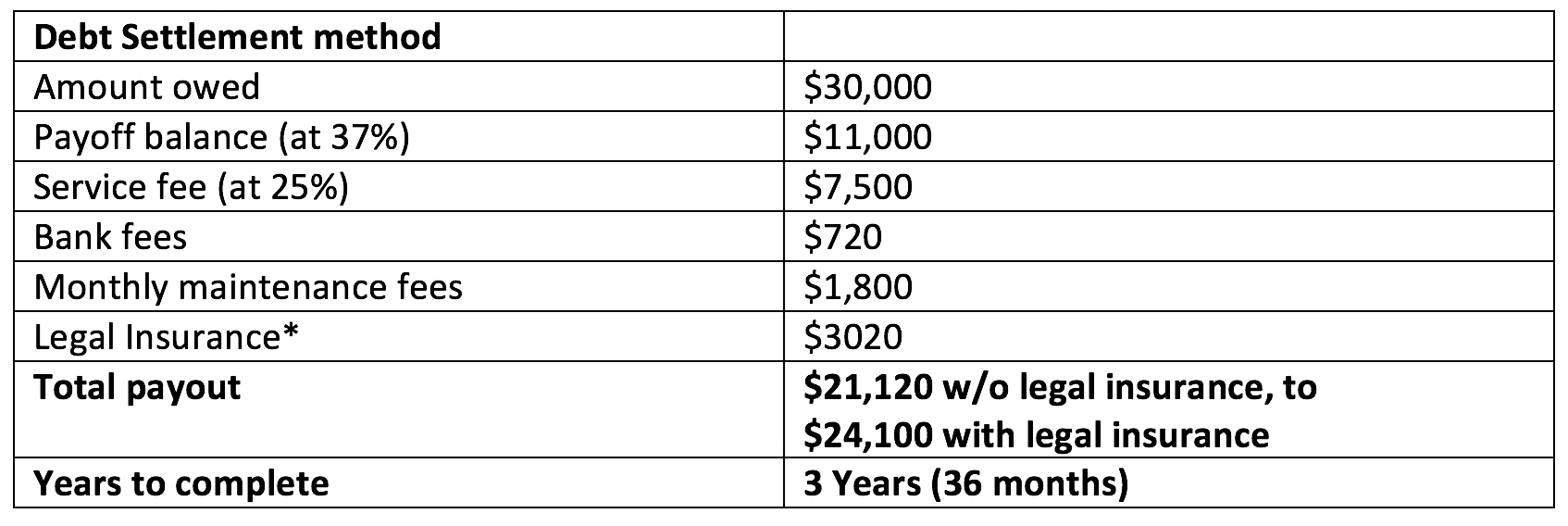

There are generally two companies in any debt settlement chain: (1) the “front end” – the sales team the markets and signs up clients, and (2) the “back end” – the team that contacts creditors and negotiates your debts. For compliance, legal, cost, and other reasons the “front end” and “back end” are often separate companies, but not always. Nevertheless, I will refer to them as one company for the purposes of this discussion.

By experience and research debt settlement companies will achieve a settlement of between 25-50% of the debt you owe. One company states a 37% average. That means if you owe $30k, you will pay $11,100 of the balance owed.

To achieve settlement, you will stop paying on your credit cards and other unsecured debts and set aside a predetermined amount into a bank account you control each month. The debt settlement company only monitors the account. When the account builds up enough funds, the debt settlement company negotiates a settlement, and if you approve, you authorize the payment of the funds to complete the transaction.

There are fees involved. Generally, debt settlement companies will charge 25% of the total enrolled debt, and there are bank account fees for your settlement account. There may also be a monthly maintenance fee – usually $50 or so, and possibly legal insurance fees, if you available at approximately $500 initial set up and $70 per month thereafter. In total this may seem like a lot but add it up and you are still saving a lot of money. Most people will think of it against their current balance, but that’s wrong. You need to compare it to payoff balances where fees, interest, and penalties accrue. Also, you are saving a lot of time. Debt settlement takes 3 to 5 years on average!

*Legal Insurance: Some debt settlement companies offer legal insurance to their clients. Generally, a client will pay a larger upfront fee, perhaps $500 or so, and then monthly fees of $50 to $70. Around $3020 in total on average. Most probably won’t need it, but it can make you feel safer (which is worth something). A debt settlement company worth its salt should be able to handle most threats of litigation a person may get. Their job is to negotiate debts, after all. On the offhand chance you need it, when a suit is filed, you’ll be glad you’ve got it. And, as with any lawsuit, you should get an attorney.

So how do you decide?

Know your general timelines and the motivations of those coming after you. In our experience credit card companies won’t file suit against you for at least 8 months after you’ve stopped making payments, and probably closer to two years, if at all. When they file suit they have to find and serve you. You then have 30 days or so to respond. Which means you have 9 months or more (maybe a lot more) to have your debt settlement company work that debt. It depends on how motivated they are.

If you’re receiving letters from the creditor their motivation is to get you to pay, so you probably have more time. They are paying in-house workers who probably get paid for their work no matter their results. A lawsuit only costs the company more money. Not a smart business practice for most cases. If you’re receiving threatening letters from a collections company, they get paid by the payments you make to them, and the worker gets commission. So they will probably give you more time too. A lawsuit probably cost $3000 to $10,000 or more. They don’t want to spend the time, cost and effort in the courts. If you’re receiving letters threatening suit from an outside law firm (one the creditor hired to go after you), you need to move quicker. The law firm is probably getting hourly pay (billable hours) from the creditor plus a portion of any settlement or lawsuit proceeds, so their motivation is to put hours of work in, even if you don’t have money to pay. They don’t absorb the cost of the lawsuit; they profit from it.

In short, creditors get paid by you, collection agencies get paid by you, and law firms get paid by the deep pocket creditor (and possibly a bit from you too).

There are two styles of debt negotiation. A “traditional” model, where the debt settlement company doesn’t get paid until they settlement a debt. And a “legal” model, where the debt settlement company can collect some fees upfront. As long as you have a solid debt settlement company you are working with, both models are fine. Your payments should be the same every month, so you won’t feel any effects. And your debt settlement term (how many months you’ll be in the program) should also be the same. A case can be made that the traditional model appears fairer to the client, however, we don’t necessarily agree. Like a good construction company, a good debt settlement company (or attorney for that matter) provides quality services and needs capital to pay its workers. Remember, they are working for you from day one. They are providing, what you should consider, valuable services. In either case, honor the process.

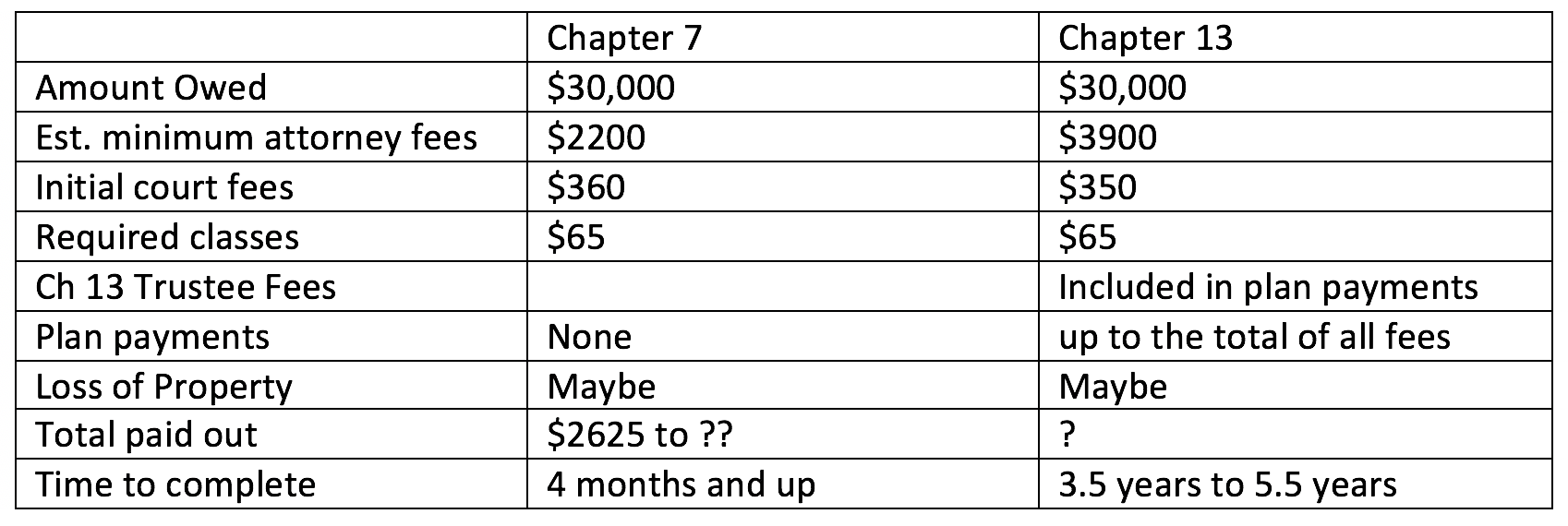

Bankruptcy:

There are two main types of bankruptcy. Chapter 7 is a “wipeout” of debts. Chapter 13 is a three-to-five-year re-payment plan (most people get 5 years). Chapter 7 attorney fees are somewhere between $1500 to $3500, and Chapter 13 attorney fees are between $3600 to $6000 to start and go up from there. Filing fees for the initial court paperwork are $350 and up. Depending on the services you need, the attorney fees and court fees can and often do go up. And Chapter 13 has trustee fees attached to any payment plan.

Chapter 13 payment plans are normally based on your disposable income and/or any arrears on property you wish to keep. For example, if you don’t have any unsecured debt but need to file the 13 to catch up on missed mortgage payments, you may do so (if feasible). Or if you only owe unsecured debts (usually credit cards) you will have to pay all your disposable income into the payment plan until either the debt is paid off or your payment plan term has ended. Your disposable income is determined by a budget you submit to the court and can be challenged by the trustee. But don’t think you get to determine what counts in your budget and for how much. The laws control what is allowed, and how much each budget item can max out at. There have been plenty of times that debtors insist something in their life must be paid for, that it is a necessary expense, only to have the court rule against them.

In addition, while debtor’s prison doesn’t exist anymore (though I’ve had plenty of people ask me worriedly about it), there is a big catch. The court can take your property and sell it off. Each bankruptcy case has a trustee appointed to oversee and control your property and approve your paperwork. Their sole job is to determine what assets you have that are available for seizure. Cash in the bank, a car worth more than a few thousand dollars, inheritances, jewelry, collectables, real estate, and even heirlooms are all under scrutiny. If any are unprotected by law, they will demand you turn them over. The trustee’s will either appoint someone to seize and sell the asset or will do it themselves. If they are partially protected by law, you can either buy the difference from the trustee or get some money back from the trustee’s sale. And if you think the Trustee’s aren’t motivated to do so, then you are mistaken. Trustees will get a percentage of what they collect, or at least charge a “reasonable” fee for their services. And the person/entity they appoint to seize and sell your assets will get a pay day too. Most often, trustees know the auction houses and people they use for such services and develop a business relationship with them. It is only once they are all paid that the Trustee distributes the remaining amounts to your creditors.

You will also be required to take two education classes. One before you file your case, and one after.

Chapter 7 cases can end in as little as 100 days from filing, but I’ve seen trustees keep cases open for a few years in order to seize property that will come available in time. Chapter 13 cases will generally end within 6 months of your last plan payment.

CREDIT REPORTS AND WHAT REALLY MATTERS

How credit reports work. An individual lender, such as an auto dealer, provides information about their transactions with you to the credit bureaus. The credit bureaus collect that data, as well as data from every other lender you deal with. They compile their report and assign each person’s report a credit score. However, note that as every lender may not report to each credit bureau, each credit bureau report may contain different information and provide a different score.

When considering giving you a new loan or line of credit, a lender such as the car dealer, request a copy of a report from one, two or all three of the credit bureaus. They consider the report in determining whether to give you a loan or not, and what the terms of the loan they offer will be.

And know that while laws govern some aspects of the reporting, the credit bureaus are private companies, not part of the government. They are in it to make money as well.

What is a credit report? Truly… A credit report is an indication of your ability to pay. That’s it. If you pay, you make the lender money. If the lender makes money, they are happy. So, a credit report is advice to a lender on the chances you’ll make them happy (i.e., your ability to pay).

But it is not the “end all be all” of a lender’s decision. Certainly, a credit report is a tool to help them decide on whether to do business with you (i.e., give you a loan or a credit card) but other factors will come into play when you are seeking a loan, and those other factors can be more important. First and foremost is the amount of your disposable income. How much money do you have left after you pay all your bills. Lenders want to know you have the funds available each month to make your payments.

Put yourself in their shoes and ask yourself this: would you rather lend to someone with an 850-credit score and $50 disposable income each month, or someone with a 650-credit score but $2000 disposable income each month? That’s a simple decision (take the money!). There’s a reason you’ve heard of people and businesses filing bankruptcy then turning right around and getting credit. It’s because they have the disposable income to make them a good candidate in the lender’s eyes.

So, what really matters. You want to get healthy on two things: disposable income and your credit score (and we’d recommend doing it in that order!). Do not make the mistake of living by your credit score alone, you will end up dying by lack of disposable income.

Getting healthy on disposable income is a math formula. Pay off what you owe or make more money, or both, and don’t obligate it elsewhere (i.e., don’t take on more debt).

Getting a healthier credit report is formulaic as well. A credit report (for the most part) covers the most recent 10 years. As you enter a new month, the oldest month falls off. So you want to add good months on the front.

But how do you do achieve both goals? Not everyone can get a raise in income, so the three main areas we want you to focus on, are:

- Getting and keeping low balances on each individual

- Having a lot of available credit (room) on all your accounts combined.

- Making creditors money (make them happy!).

So how does this play out for our scenarios:

Minimum Monthly Payments (“Working Out On Your Own”)

This is simple. If you make minimum monthly payments, it will take about 20 years and 3x the current balance to pay off your debt. That is scary. Check your card statement. There is a box on each one giving you the details.

And it also creates a big hole that most people fall back into. When you pay down a card and get room on it, you charge it back up. And then you add years and a lot of interest to the payoff timeline and balance. It’s a vicious cycle.

Work out for a few weeks. Start to feel good. Pants are getting looser. Decide you can take a weekend off. Someone orders pizza. Next thing you know, it’s been three weeks and you have cookie crumbs on your shirt as you binge watch Netflix. Start all over again. Rinse and repeat…

You will have little to no disposable income for the next twenty years. And you the new months that you add on to your credit report will have a small change in debt levels from the ones that fall off.

Disposable income – none to very little for 20 years.

Credit Report – slowly rises over the next twenty years.

CAVEAT:

If you are stuck and can only afford Minimum Monthly Payments, I don’t recommend this path. But if you can manage an extra two hundred dollars or so each month, I have a plan for you that could speed things up. But you must have the willpower to stay disciplined and avoid temptations. No cheat days. Not for years… You also won’t have any support, and it’s a long trek. Spending money is an addiction. Recovery is tough. See the snowball plan below.

Debt Settlement (“Having a Personal Trainer”)

Make a call to a debt settlement company and be guided by an experienced counselor/debt settlement agent. If they’re good, they’ll walk you through the process. Check on you monthly. Help with issues that arise. And even Enroll your debts. Stop using your credit cards. And instead of making your payments to your debts each month, you put the money into a safe bank account that the company uses to settle out your debts.

What is more effective than trying to go it alone? Having a someone to guide you, to make your plan and coach you. Someone you must answer to. Someone to keep you honest. This is like having a personal trainer.

In most cases, the payment you agree to make into your settlement account will be lower than what your total minimum monthly payments would be. But if you can pay more each month, the sooner the debts can be negotiated and settled.

Hopefully you will pay out less than what you currently owe. But sometimes, when all fees and service fees are paid out, you may pay out as much as your total balance. But, and this is important to realize, you do not compare the settlement to your current balance. You compare the total cost of this solution to the all-in costs of other solutions. Comparing debt settlement to making minimum monthly payments, it’s not even close. In both time and money, you save a fortune.

You will have to deal with creditor calls, but it’s a small price. Also, you can search up a letter to send to stop the calls.

You can potentially have a significant amount of disposable income each month, as your payments may be smaller. And while your credit report will take a hit to start, it will clean up faster. As you settle out debts (generally) over the next 3 to 4 years, the new month added to your report have less bad information. And when you are done, the months added on are ‘clean’, so to speak. The bad months, that hold significant debt, age out and fall off your report.

This is the best plan in most cases.

Disposable income – may not be huge but can be significant.

Credit Report – will take a quick hit, then rise sharply when all debts are cleared in 3+ years.

Bankruptcy (“Surgery”)

Hire an attorney. Hand control of your property to a court appointed trustee and hope the court doesn’t take your excess cash and sell any of your property. If you have disposable income, you’ll most likely pay it over in a chapter 13 for the next three to five years (most people are on a five-year plan). If not, you may be able to wipeout your debts in a chapter 7.

A completed bankruptcy will stay on your credit report for 10 years from the end of your case. Landlords and lenders will ask if you filed. It is embarrassing.

When do you need a surgical option? When things get dire. Bankruptcy can save your financial life in those times. It can stop foreclosures, repos, lawsuits, forgive medical bills, and wipe out debts so burdensome it’s tough to breath. We are an advocate of bankruptcy in some situations. But it is a steep cost to get healthy.

In a chapter 7, which takes 3-4 months at the quickest, your debts are wiped out, so your disposable income goes up. But to qualify for a chapter 7 (with some exceptions) it generally takes people without much disposable income to qualify. And the court does not count dischargeable debts when calculating disposable income (such as credit card payments). So don’t count on a significant increase in disposable income.

In a chapter 13, all your disposable income goes to the court to pay to your creditors. But when your case is over – in three to five years -- you will have an increase in disposable income.

Your credit score will take a hit. A bankruptcy is reported on it, and debts are listed as (in some form or another) “discharged in bankruptcy.”

There is one interesting outcome with a lot of the thousand or so of bankruptcy cases we’ve seen. Ask anyone who has gone through a bankruptcy how many credit card offers they receive. Their mailbox is stuffed. Why? Because of two facts. Their money is free. It is no longer obligated to the debts they had. They now have disposable income they can allocate to new debts. That means they are more likely to pay. And secondly, they cannot file bankruptcy for another seven to eight years (in most cases). Their credit score is in the toilet, but their disposable income is high. They are more likely to pay their debts and make the creditors happy – even over non-filers. We’ve seen people get credit cards in 30 days, car loans in 90 days, and home loans within 2 years of completing a bankruptcy.

This is NOT best plan in most cases but can be effective for some. But it can be harsh. It is not to be taken lightly.

Disposable income – for a chapter 7, not much. For a chapter 13, can be significant after 5 years.

Credit Report – will take a quick hit, then rise sharply when all debts are cleared. In 6 months or so for a chapter 7. In 5 years or so for a chapter 13.

What are the Ethics of the Debt Solutions?

You’ll have to make up your own mind. But here is some of our opinions:

For minimum monthly payments add up what you’ve already paid. I bet it feels extremely unfair. Credit card companies charge 20% and more, add in service fees, yearly fees, card fees (just to have the physical card), exorbitant late fees, etc. They have strong lobbies and big political donations to sway the laws to their side. And when pushed by politicians, if that ever occurs, I would bet they point to the bankruptcy laws as the consumers safety net. Just a guess, but knowing how it works in D.C., it’s logical.

Debt settlement is a negotiation between two parties. The lender and you, as represented by your debt settlement company. No one is forced to accept the deal. It is a voluntary exchange. Lenders can say no.

Bankruptcy is a court ordered settlement. Lenders are forced to comply with the laws and may not receive any compensation, even in a chapter 13 payment plan. Although they may have various remedies, lenders do not have a choice on participation. And while a lot of religious institutions and teachers are heavily against bankruptcy, bankruptcy is based on the forgiveness debts every seven (to eight) years. Essentially the “jubilee” year. A Biblical principle.

REFUNDS

A side note, as we’ve gotten several questions about refunds during our debt settlement career. Lawyers, companies, and other parties provide services. You should expect to pay for those services. 90% or more of a lawyer’s bankruptcy services are completed before you even file your case. Filling out and analyzing your paperwork, is the majority of their work. Debt settlement companies have to set up and maintain bank accounts and systems to handle your case. And both lawyers and companies have employees and fees they must pay. And if you stop using their services you should still expect to pay for some of their services. It costs money to represent you, even if it’s for just a short while. And it is valuable to have them as available resources to you. Respect that. It will reflect in you when you honor every situation.

DISCLAIMER

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website may contain links to other third-party websites. Such links are only for the convenience of the reader, user or browser; we do not recommend or endorse the contents of the third-party sites.

Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting